Modern insurance operations run on AI-enabled policy analysis software that extracts, structures, and compares policy data at scale—without sacrificing accuracy or compliance. If you’re evaluating insurance policy analysis software for insurers, reliability starts with the feature set: can it automate underwriting decisions, integrate seamlessly with core systems, and deliver real-time insights for pricing and risk? The right platform reduces expense ratios, sharpens compliance, and opens new segments through faster, more personalized quoting. In this guide, we break down the 10 capabilities that matter most and how to use them to achieve operational excellence. Throughout, we’ll reference how Further's expertise in commercial insurance—spanning underwriting audits, policy comparisons, and end-to-end workflow automation—helps carriers, MGAs, brokers, and reinsurers transition from manual effort to measurable outcomes.

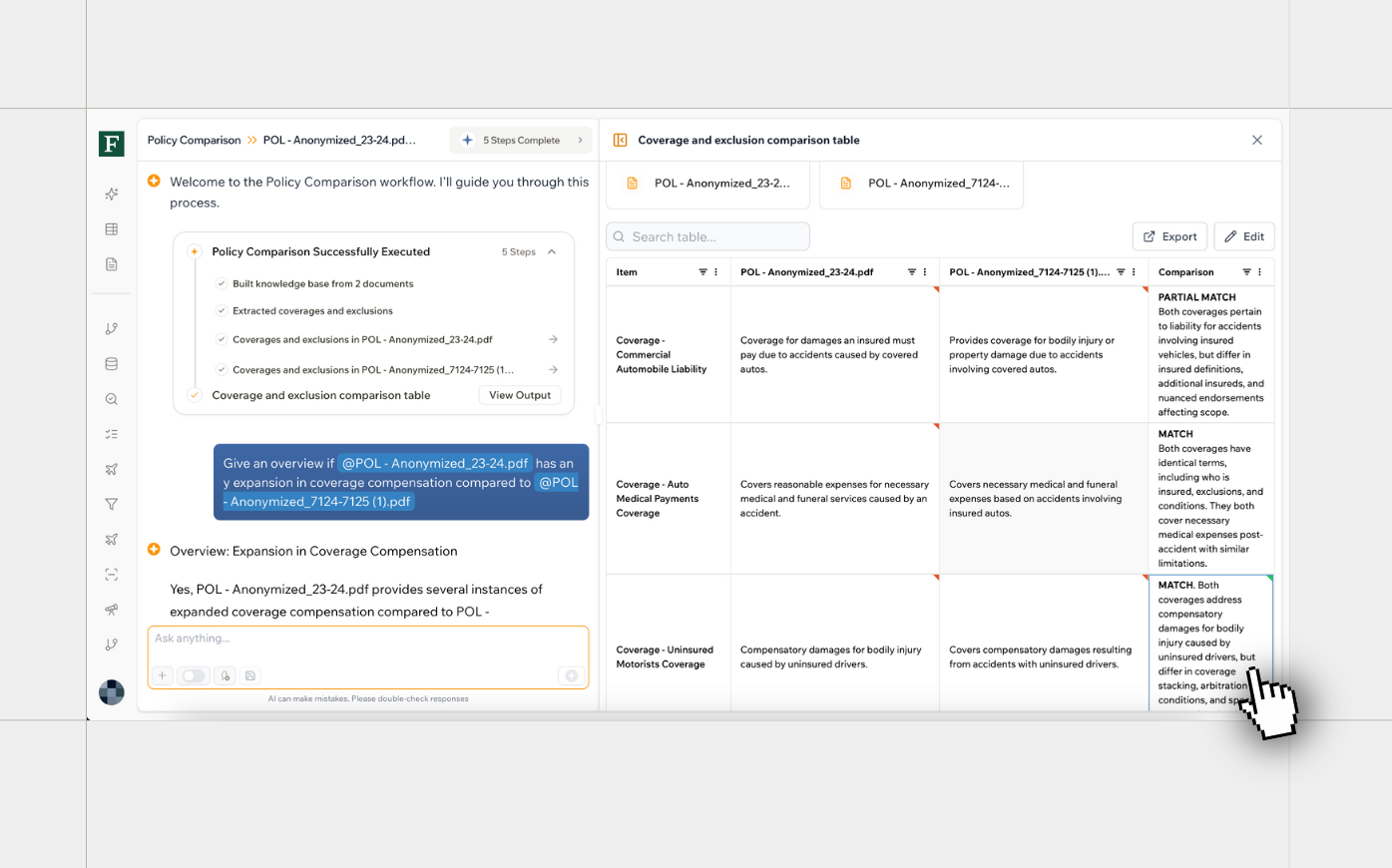

FurtherAI's AI-Powered Automation for Insurance Policy Analysis

Further accelerates policy data extraction, structuring, and decisioning up to 30× faster than manual workflows, cutting operational costs while reducing human error. Teams use it to ingest and analyze submissions, validate claims documents, run underwriting audits, and compare bound policies against quotes and endorsements—creating scale, standardization, and clearer portfolio insights. With deep insurance domain expertise and prebuilt integrations (Salesforce, email, data vendors like PitchBook), organizations typically see ROI in months, not years. For a broader view of efficiency gains, see our analysis of the real ROI of AI in commercial insurance operations from Further's research.

Configurable Underwriting Engine for Personalized Quotations

A configurable underwriting engine lets insurers adjust rules, factors, and eligibility criteria to deliver dynamic quotes and product personalization. Instead of rigid, one-size-fits-all scoring, teams can tune appetite, weighting, and referral triggers per segment, product line, or geography—speeding time-to-quote and improving precision. Industry reviews of the P&C software landscape consistently point to flexible rules engines and prebuilt integrations as differentiators for faster, more accurate quoting (see this overview of the P&C software landscape).

- Enables faster time-to-quote by automating risk evaluation

- Supports varied product configurations for different market segments

- Reduces manual underwriting workload and errors

Real-Time Data Analytics and Predictive Modeling

Predictive modeling uses statistics and machine learning to forecast outcomes—such as claim probability, loss ratio, or premium leakage—from historical and real-time data. When analytics are embedded directly in workflows, underwriters get decision-ready insights the moment they need them, increasing speed and profitability. Industry benchmarks illustrate the standard: Guidewire Analytics is embedded across core insurance workflows, and SAS Analytics is used by roughly 90% of Fortune 500 insurers, reflecting broad confidence in its predictive capabilities (see this insurance analytics software overview).

Recommended analytics platforms at a glance:

Regulatory Compliance and Risk Management

Regulatory compliance in insurance means the software automatically updates and enforces region-specific rules, filings, and audit requirements—while documenting every decision for examination. Leading platforms pair explainable AI with controls that make pricing and underwriting transparent to regulators and internal audit. Guidewire’s PricingCenter, for instance, emphasizes explainable decisioning and market-specific governance controls to manage risk across geographies and lines, helping teams operationalize compliant pricing and monitoring (see Guidewire PricingCenter).

Core compliance features to expect:

- Automated rule updates for global/regional insurance laws

- Continuous risk assessments and watchlists

- Comprehensive audit trails and evidence capture

Seamless Integration Capabilities with Existing Systems

Integration capabilities describe how well the software connects—via APIs, webhooks, and data pipelines—to core policy administration systems, CRMs, rating engines, payments, e-signature, and data providers. Strong integrations eliminate rekeying, unify data, and enable straight-through processing. Reviews of leading P&C platforms consistently note that open APIs and prebuilt connectors accelerate implementation and improve reporting across the stack (see the P&C software landscape overview above).

Common integration targets and benefits:

- CRM and intake (e.g., Salesforce) to standardize submissions and triage

- Policy administration systems to sync quotes, endorsements, and documents

- Data vendors (e.g., PitchBook, sanctions/loss runs) to enrich risk views

Cloud-Optimized Deployment for Scalability and Flexibility

Cloud-optimized deployment means the platform is built for modern cloud infrastructure—supporting elastic scale, remote access, automated updates, and reduced IT overhead. Cloud-first tools like SAS Viya and Guidewire InsuranceSuite help teams ship models and decisions faster, with the agility to adapt to new products and volumes without large capital spends (see the insurance analytics software overview).

Benefits to prioritize:

- Rapid onboarding and secure remote access for distributed teams

- Elastic scaling for seasonal or segment-driven policy volumes

- Enterprise-grade security controls and seamless version upgrades

Advanced Analytics and Customizable Reporting

Advanced analytics and customizable reporting turn raw data into decisions: trend analysis, loss development views, KPI visualizations, and tailored reporting for executives, regulators, and partners. Agency and carrier tools that provide real-time dashboards have shown measurable gains in data-driven management; for example, industry write-ups highlight platforms like Applied Epic for built-in dashboards and agency-level insights that support faster decisions (see this overview of insurance software tools).

Reporting features to require:

- Real-time dashboards and threshold-based alerts

- Benchmarking, cohort analysis, and portfolio performance

- Self-service report builders with scheduling and export

Automation Features to Streamline Routine Tasks

Automation features are system capabilities that execute repeatable tasks—renewals, quote retrieval, certificate issuance, document checks—without human intervention. In practice, teams report moving from hours to minutes for common agency tasks when automation and client self-service are in place, freeing staff for higher-value work like account rounding and complex risk reviews (see this guide to insurance agency software).

A practical automation checklist:

- Auto-renewals with rule-based exceptions and reminders

- Certificate and document generation with template controls

- Task orchestration for compliance workflows and approvals

Intuitive and User-Friendly Interface Design

An intuitive interface makes it easy for users to navigate, enter data accurately, and complete tasks quickly—driving adoption and reducing training time. Research on agency tools shows client portals and clean UIs reduce back-and-forth and busywork while improving customer satisfaction and retention (see the insurance agency software guide above).

Interface must-haves:

- Logical, role-based workflow navigation

- Clear dashboards, search, and embedded help

- Responsive design across desktop, tablet, and mobile

Transparent and Cost-Effective Pricing Models

Transparent pricing means clear, upfront detail on per-user or usage-based fees, included features, and support levels—so you can compare total cost of ownership across vendors. Industry roundups note that mainstream agency systems offer tiered pricing aligned to agency size, with mid-to-high tiers commonly in the $150–$200 per user per month range; larger carrier deployments vary with usage and integration complexity (see this review of top agency management systems).

Questions to ask vendors:

- What is the total cost of ownership over 3 years (licenses, services, add-ons)?

- Which features are included at each tier, and what triggers overage fees?

- What support, SLAs, and success resources are included?

Reliable Customer Support and Service Excellence

Customer support covers multi-channel access to help (chat, email, phone), training resources, implementation assistance, and proactive health checks. Leading vendors emphasize fast resolution times, structured onboarding, and ongoing enablement for agencies and carriers alike—capabilities consistently cited as critical to long-term satisfaction and uptime (see this roundup of insurance software tools).

What to evaluate:

- Guaranteed response times and escalation paths

- Implementation services, admin training, and user enablement

- Published client satisfaction metrics and references

Frequently Asked Questions

What should I consider when choosing insurance policy analysis software?

Focus on underwriting configurability, real-time analytics, integrations, automation, and strong support to meet operational, compliance, and ROI goals.

How does automation improve insurance policy workflows?

It streamlines routine tasks like renewals and certificates, reducing errors and cycle times while freeing staff for higher-value underwriting and client work.

Why is integration with existing systems critical for insurance software?

Tight integrations eliminate data silos and rekeying, enabling unified reporting and straight-through processing across core platforms and CRMs.

What role do analytics play in insurance policy management?

Analytics provide decision-ready insights and forecasts, improving pricing, risk selection, and portfolio performance.

How can cloud deployment benefit insurers using policy analysis software?

Cloud deployment scales on demand, enables secure remote access, and delivers automatic updates that keep performance and security current.

Ready to Go Further &

Transform Your Insurance Ops?

Reclaim your time for strategic work and let our AI Assistant handle the busywork. Schedule a demo to see how you can achieve more, faster.

.png)

.png)